These strategies can help you create a steady stream of income for retirement, current expenses or other financial goals

Growth is usually the main point of an investing strategy. But depending on your goals, income-producing investments may be equally if not more important. From helping to pay for college and funding a home purchase to supplementing retirement spending in the future, a portfolio that produces a steady stream of cash can make it easier to reach important financial milestones.

When you want to supplement your cash flow with income-paying investments, here are four tactics to consider. Remember: Your investment plan should reflect your unique financial circumstances.

1. Seek out investments that pay dividends.

By offering regular payments to shareholders, dividend-paying stocks can be a source of steady cash.Footnote 1 Share prices may rise or fall depending on the company's health and outlook, but these stocks have the potential to gain value while paying reliable dividends despite the fluctuations of the market, notes Matthew Diczok, head of fixed income strategy, Chief Investment Office, Merrill and Bank of America Private Bank.

2. Be strategic with bonds.

When you're looking for

income from bonds, what happens to prices may be less important than the interest they pay, Diczok notes. "The first and most important thing bonds provide is regular, high-quality income," he says. See the chart below to learn about the many flavors of bonds available.

Understanding the bond universe

Different types of bonds offer varying degrees of risk and potential income.

Investment-grade corporate bonds

These types of bonds are issued by private companies with high credit ratings. Their prices are generally less volatile than the stock market.

Treasury bonds

Issued and backed by the U.S. government, these are among the safest income-generating investments. However, rates are usually one or two percentage points below those provided by high-quality corporate bonds of the same maturity.

Municipal bonds

Issued by state and local governments, muni bonds generate income that is usually exempt from federal income taxes and may also not be subject to state and local taxes. The trade-off is a relatively modest rate of return. It can be helpful to compare the after-tax return of other bonds with the interest from municipals.

High-yield bonds

These bonds generally offer higher interest rates than investment-grade corporate bonds but are considered more volatile, with prices fluctuating more than those of other bonds, and sometimes as much as stocks.

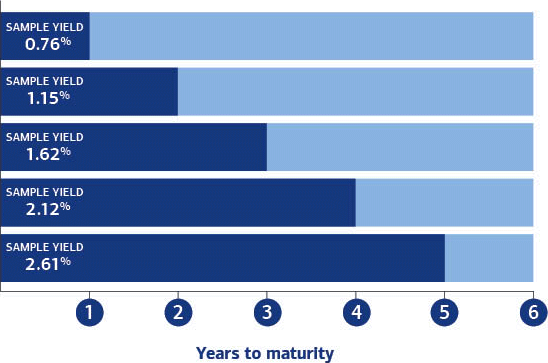

"Most income investors want regular, reliable payments, which means owning individual bonds with a range of different maturities," Diczok says. A strategy called bond laddering can provide this. It involves creating a portfolio in which you buy individual bonds that mature continuously at equally spaced intervals. See the illustration below.

How to build a bond ladder

With $10,000 to invest, you can put $2,000 into each of five individual bonds that mature over five years. As one bond matures every year, you can extend the ladder by reinvesting the proceeds at current interest rates — or put the funds to other uses.

A bond with one year to maturity has a sample yield of 0.76%. A bond with two years to maturity has a sample yield of 1.15%. A bond with three years to maturity has a sample yield of 1.62%. A bond with four years to maturity has a sample yield of 2.12%. A bond with five years to maturity has a sample yield of 2.61%.

A bond with one year to maturity has a sample yield of 0.76%. A bond with two years to maturity has a sample yield of 1.15%. A bond with three years to maturity has a sample yield of 1.62%. A bond with four years to maturity has a sample yield of 2.12%. A bond with five years to maturity has a sample yield of 2.61%.

Note: The yield rates used are solely intended to illustrate a hypothetical yield curve scenario and are not indicative of the current market environment or a specific investment portfolio.

3. Streamline your income investing via mutual funds and exchange-traded funds (ETFs).

For the average investor, "the most cost-efficient way to build a bond or dividend-paying stock portfolio may be through

ETFs and

mutual funds," says Diczok. "These funds can give you diversified access to a range of securities and cut down on transaction costs." Compared with owning a handful of individual bonds, for instance, a typical bond market ETF or mutual fund may offer thousands of bonds, providing very broad diversification. If you invest in a fund that follows a dividend strategy, there is an emphasis on buying dividend-payers that produce income. And with bond mutual funds, you get the added advantage of fund managers who factor in various kinds of risk when selecting their holdings, Diczok says.

4. Focus on your overall returns rather than short-term market movements.

When you're deriving the income you need from an investment, it doesn't matter as much if the value of the underlying asset fluctuates, regardless of whether it's a stock or a bond. "If you're still receiving regular income and there is no fundamental change in the borrower's creditworthiness, there's less reason to panic if the market value of your investment goes down somewhat," says Diczok, "especially if it's a bond you plan to hold till maturity."

Whatever combination of approaches you use, he adds, make sure they are appropriate for your goals, timelines and

risk tolerance. If you work with a financial advisor, they can help you come up with the best approach for your situation.

Footnote 1 Dividend payments are not guaranteed and are paid only when declared by an issuer's board of directors. The amount of a dividend payment, if any, can vary over time.

Important Disclosures

Opinions are as of 09/10/2025 and are subject to change.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Bank of America, Merrill or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., ("Bank of America") and Merrill Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S" or "Merrill"), a registered broker-dealer, registered investment adviser and a wholly owned subsidiary of Bank of America Corporation ("BofA Corp.").

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Bonds are subject to interest rate, inflation and credit risks. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration.

Diversification does not ensure a profit or protect against loss in declining markets.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

Investments in high-yield bonds (sometimes referred to as "junk bonds") offer the potential for high current income and attractive total return but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a junk bond issuer's ability to make principal and interest payments.

Income from investing in municipal bonds is generally exempt from federal and state taxes for residents of the issuing state. While the interest income is generally tax-exempt, any capital gains distributed are taxable to the investor. Income for some investors may be subject to the federal alternative minimum tax (AMT).

Investments focused in a certain industry may pose additional risks due to lack of diversification, industry volatility, economic turmoil, susceptibility to economic, political or regulatory risks, and other sector concentration risks.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

MAP8571128-05282027