Consequences:

Non-pattern day trader (Non-PDT)

If your non-PDT account is restricted due to day trading, you'll lose your ability to exceed your day trade buying power for opening trades online. You may bring in cash equal to the amount by which you exceeded your day trade buying power or deposit marginable securities to have the restriction canceled. If you wish to deposit marginable securities, contact us.

Pattern day trader (PDT)

First four business days

If you incur a day trade call, your account will be restricted to twice your start-of-the-day Firm Maintenance Excess plus cash for opening transactions. You'll have four business days to address the call before your account will be further restricted.

You may bring in cash equal to the amount by which you exceeded your day trade buying power or deposit marginable securities to have the restriction canceled. If you wish to deposit marginable securities, contact us.

Fifth business day

Should the four-day window elapse and you do not take action to resolve the call, your account will be further restricted to your start-of-the-day Firm Maintenance Excess (FME) and cash for opening transactions.

You can still bring in the cash or securities to have the restriction removed. If you wish to make the deposit after the first four business days, contact us.

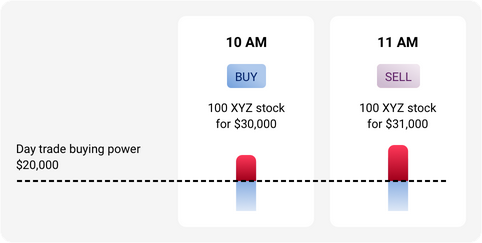

Example 1 - Buying and selling a position above your buying power

For illustration purposes only

Your account has $20,000 in day trade buying power

At 10 a.m., you purchase 100 shares of XYZ stock for $30,000. At 11 a.m., you sell the shares for $31,000.

This would trigger a day trade call because the value of your day trades exceeded your day trade buying power by $10,000.

Because of this, you can't trade the full position without incurring a day trade call. However, you can sell a portion of the position. At a purchase price of $300/share, the number of shares sold cannot exceed 66 without exceeding the $20,000 day trade buying power ($20,000 ÷ $300 = 66.66 shares).

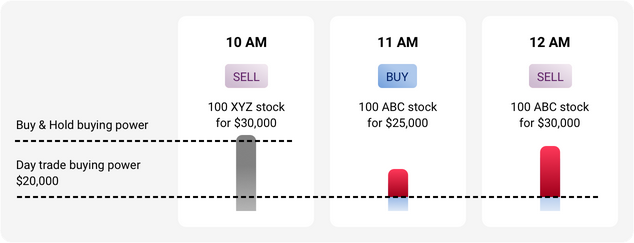

Example 2 - The effect of selling shares on your day trade buying power

For illustration purposes only

Your account has $20,000 in day trade buying power

At 10 a.m., you sell 100 shares of XYZ stock for $30,000. At 11 a.m., you buy 100 shares of ABC stock for $25,000. At 12 p.m., you sell 100 shares of ABC for $30,000.

You've incurred a day trade call because you exceeded your day trade buying power by $5,000. The sale of XYZ does not increase your day trade buying power, since it is based on start-of-the-day availability. At a purchase price of $250/share, the number of shares sold cannot exceed 80 without exceeding your $20,000 day trade buying power ($20,000 ÷ $250 = 80 shares).

Selling securities already held in your account increases your buy and hold buying power but does not affect your day trade buying power.

Steps to resolve day trade violations

You may bring in cash or marginable securities at any time you are restricted to resolve a day trade violation.

- Any cash withdrawals made after incurring this violation will increase the call amount. The cash must be returned to your account along with the call amount for the violation to be canceled.

- Funds deposited to meet a day trade call must remain in your account for two full business days, not including the date of deposit. For example, if funds are deposited on Tuesday, they must not be withdrawn until Friday.

- You may need to call us to resolve the violation.

Tips to avoid day trade violations

- You can't liquidate positions in your account to meet a day trade call as you would to satisfy other calls.