Portfolio diversification is still important as you near retirement

After you've addressed your short-term income needs, it's time to review your portfolio to see whether it has the potential to last 30 or more years, and then to adjust your asset allocationFootnote 3 as needed.

You may be tempted to play it safe at the beginning of retirement. Yet taking a cautious approach out of fear of stock market volatility might lead you to favor only lower-risk — and lower-yielding — investments such as bonds, CDs, money market funds and Treasury bills. And over a 30-year retirement, an all-cash portfolio may not be able to keep pace with inflation or rising healthcare costs. Diversification is vital.

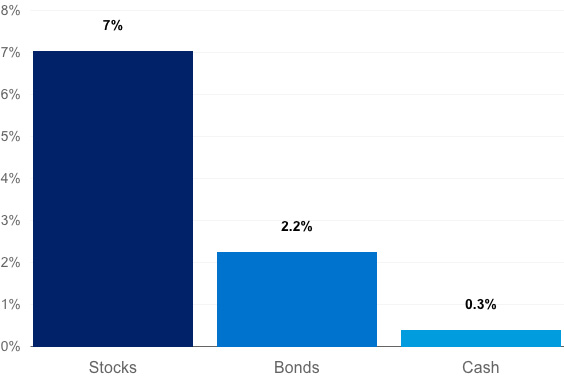

This chart shows the potential risk of relying on cash. Over the long term, cash has kept up with rising prices, while stocks and bonds have delivered average annual returns that have exceeded the rate of inflation over this time period.

Returns after inflation 1926-2022

Graphic showing annual returns after inflation from 1926 to 2022. The return is 7.0% for stocks, 2.2% for bonds and 0.3% for cash.

Source: © Morningstar 2023 and Precision Information, dba Financial Fitness Group 2023. Stocks are represented by the Ibbotson® Large Company Stock Index, which tracks the monthly return of S&P 500. Bonds are represented by the 20-year U.S. government bond, cash by the U.S. 30-day Treasury bill and inflation by the Consumer Price Index. Assumes reinvestment of income and no transaction costs or taxes.

Past performance is no guarantee of future results. This is for illustrative purposes only and not indicative of any investment.